WHAT YOU SHOULD KNOW ABOUT UAE TAX RESIDENCY

UAE Tax Residency Certificate (or TRC (for short) or UAE Tax Domicile certificate) is an official document issued by the UAE Ministry of Finance electronically (before mid-2018 it was a paper document) to individuals and corporate entities residing in the UAE. Based on this certificate, UAE tax resident can be relieved from taxes in his home country as he is considered a tax resident of the UAE. A certificate can be issued either in English or in Arabic. The validity and authenticity of the document can be verified online.

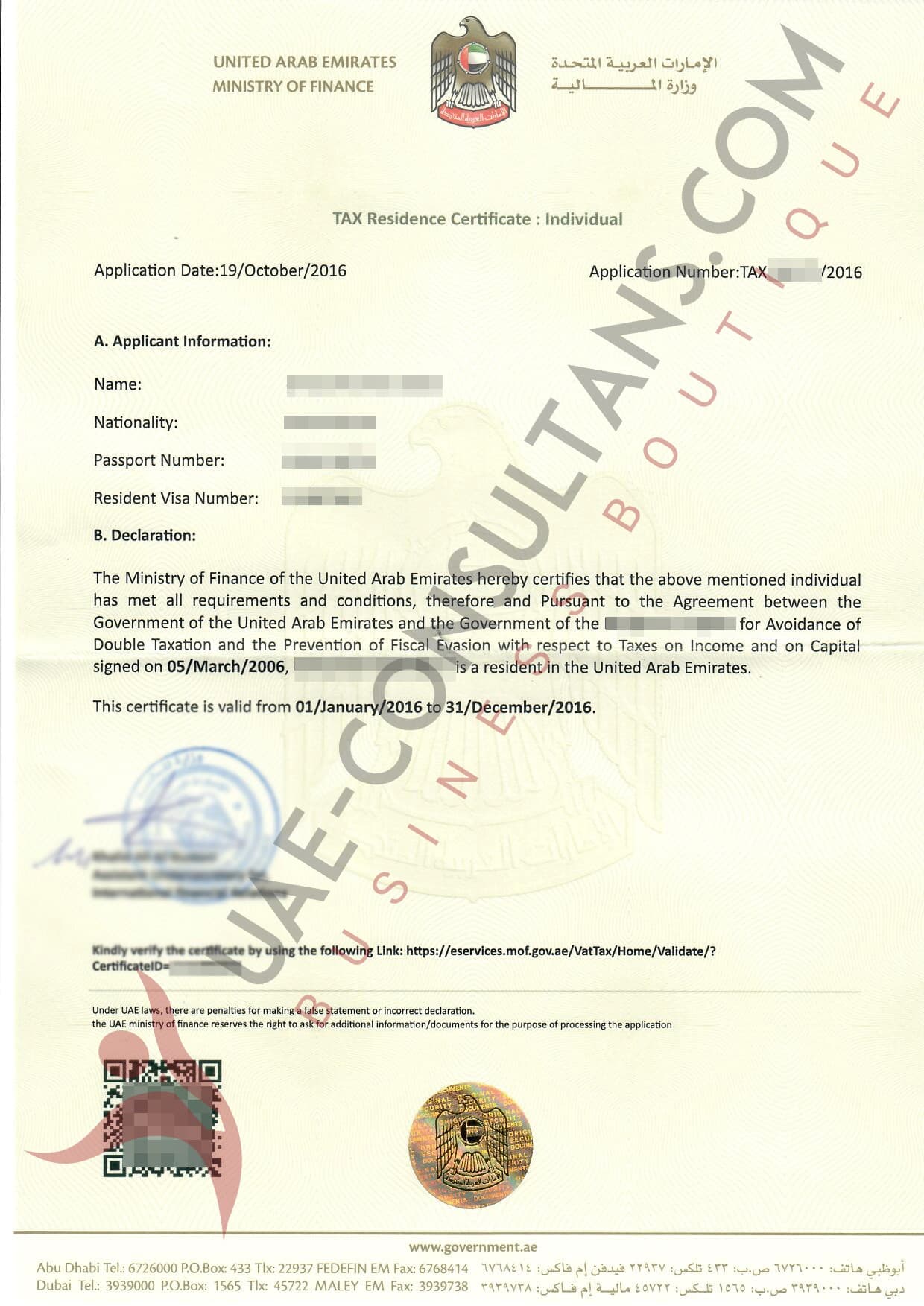

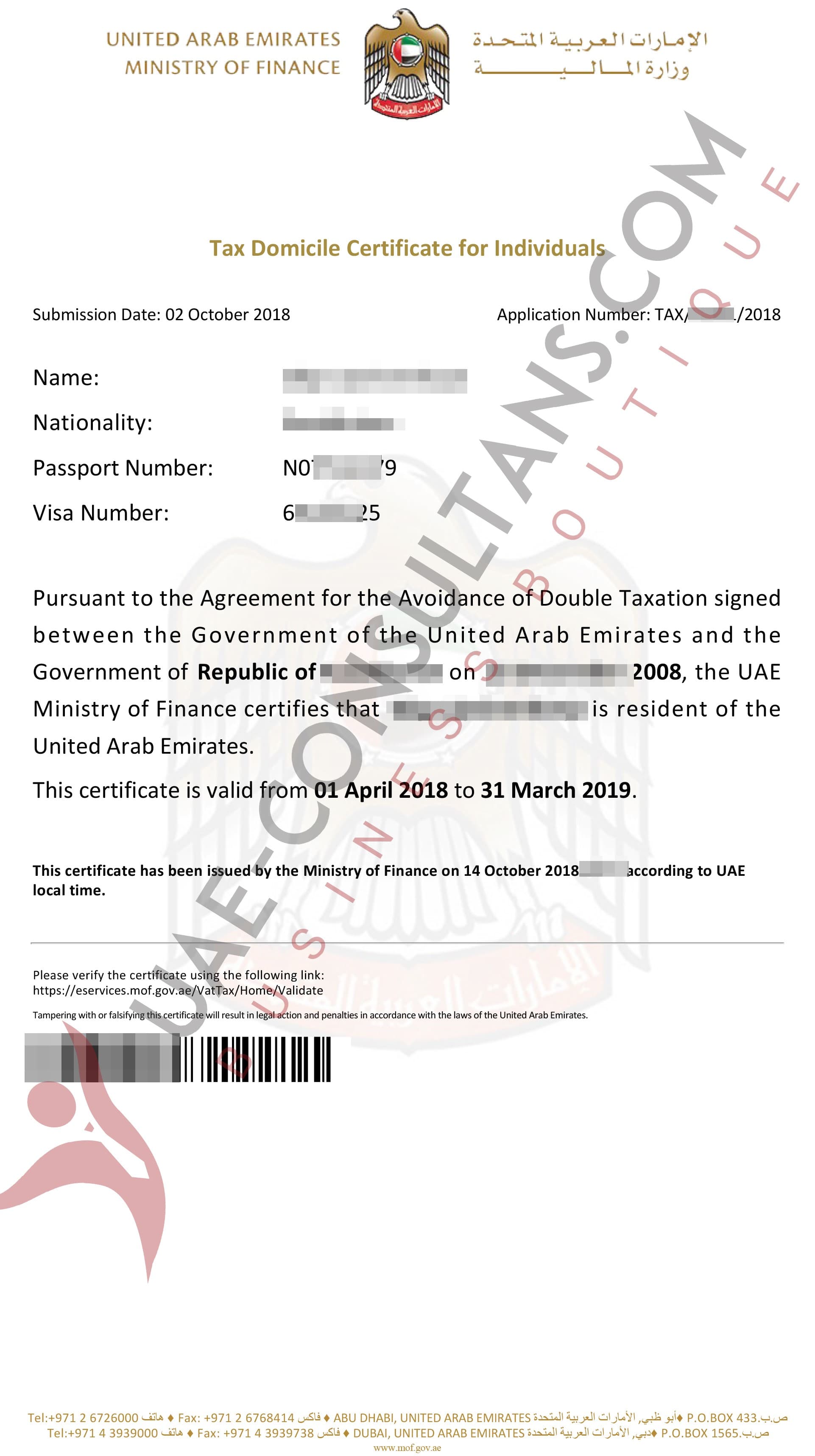

How Tax Residency Certificate looks like:

Old UAE Tax Residency Certificate Before July 2018

New UAE Tax Residency Certificate - Now Issued

As of today, tax residency in the UAE is not determined by the number of days resident spends inside the country but rather by the number of days of being the resident.

WHAT YOU SHOULD KNOW BEFORE APPLYING FOR TRC

To qualify for tax residency individual has to obtain:

1). A UAE resident visa (link: How to get a UAE resident visa?),

2). Receive regular monthly payments into his/her bank account in the UAE (i.e. salary, etc.) (link: How to open a personal bank account?)and

3). Maintain resident status by entering the UAE not less than one time per half year.

UAE tax resident qualifies for Tax Residency Certificate (TRC) after six months since UAE resident visa is issued and stamped in individual’s passport, there is a 6-months bank statement and 6-months of the lease contract

UAE Tax Residency Certificate TRC is valid for a period of one year and since mid-2018 is issued electronically. Once the validity of a certificate expires a new certificate can be requested.

! Before you apply for UAE Tax Residency certificate and invest money, make sure the country you are preparing it for is in the list of the countries, that signed Avoidance of double taxation treaty with UAE.

! All tax related assistance is provided through our reliable business partners licensed by the relevant government authorities. We, however, remain your primary point of contact to ensure that all your requests are attended in a swift manner and you have a single point of contact.